The answer below is via http://wrangle5500.com/voluntary-benefits/

The answer no doubt will frustrate you…Maybe. Some Voluntary Benefits are to be reported and others are not. For example:

- ABC Company offers an Aflac Critical Illness benefit and is to be reported in the Form 5500 (even though the participant pays 100% of the premium).

In contrast

- Smith Company permitted Aflac to publicize to its employees a Critical Illness benefit. This benefit is also 100% paid by the employee. However, the critical illness benefit For Smith Co. is not to be part of the Benefit Plan nor is it reported in the 5500.

How can the same benefit through Aflac be treated differently?

The key to knowing if the voluntary benefit should be reported within a Form 5500 all depends on if the Plan Sponsor endorses the benefit policy. To endorse does not mean to simply pay a portion or full amount of a benefit’s premium. This would make the decision to include or not include too easy. Endorsing by the Plan Sponsor can be done in a number of different ways, some so subtle that often the Plan Sponsor endorses inadvertently.

Here is the general list of nine forms of endorsing which could position the voluntary benefit to be an ERISA Voluntary benefit.

- Selecting an Insurer

- Negotiating the terms and linking coverage to Employee Status

- Using Employer’s name/Associating policy with other Employer’s policies (i.e. OE material).

- Recommending policy

- Including the benefit within its Wrap Plan Document and SPD

- Saying ERISA applies

- Conducting more than permitted payroll deductions

- Allowing Employees to pay premium through ER’s Cafeteria Plan on a pre-tax basis

- Assisting employees with claims and disputes

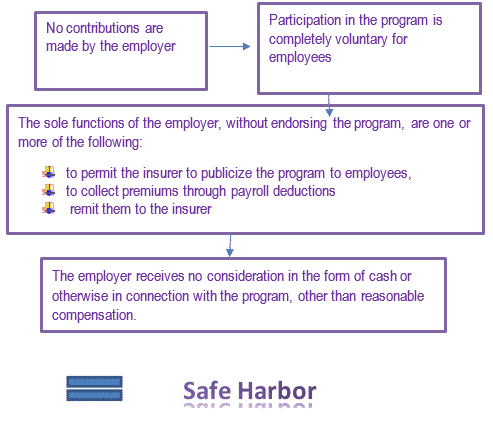

Here is another way to look at endorsing…by viewing what could lead to not endorsing (also known as reaching Safe Harbor).

According to the DOL, the employer’s neutrality is the key to the safe harbor.

Per the DOL: An endorsement within the meaning of section 2510.3-1(j)(3) occurs if the employee organization urges or encourages member participation in the program or engages in activities that would lead a member reasonably to conclude that the program is part of a benefit arrangement established or maintained by the employee organization.”

To add more spice to the scenario, there are two other factors to consider:

First, some benefits regardless of being endorsed or not, are not to be reported on a 5500 since they are never to be under ERISA. Some of these are:

- Section 132- Commuting Benefits

- States of NY, NJ, CA, RI and HI plus Puerto Rico mandated temporary disability insurance – partial wage replacement for workers who are unable to work due to non-work related injuries or illnesses, including pregnancy.

- Benefits provided outside the US for non-resident aliens

- Workers Compensation (with an exception for the State of Texas Worker Injury Benefit)

- Health Saving Account – HSA (generally no)

Second, if the benefit is simply listed in the Wrap Plan Document and SPD, the benefit would very likely need to be listed in the Form 5500. After all, the Wrap Plan Document and SPD are establishing the benefits of the ERISA Plan.

Overall, to determine endorsing is not easy; to make the decision is a difficult one due to many aspects in grey. Some may feel to take the conservative road and include the benefit in the Form 5500. This should only be done with careful consideration. To include within the Form 5500 subjects the benefit to all of ERISA such as COBRA. When there is uncertainty, the best approach is to ask an ERISA attorney to review and offer advice.

One important note to point out: A benefit subject to ERISA is not to be deemed as a deterrent. By being under ERISA, there are restrictions for legal actions on claims to federal court and ERISA rules; additionally being under ERISA limits the ability of the plaintiff to utilize potentially more liberal state laws.