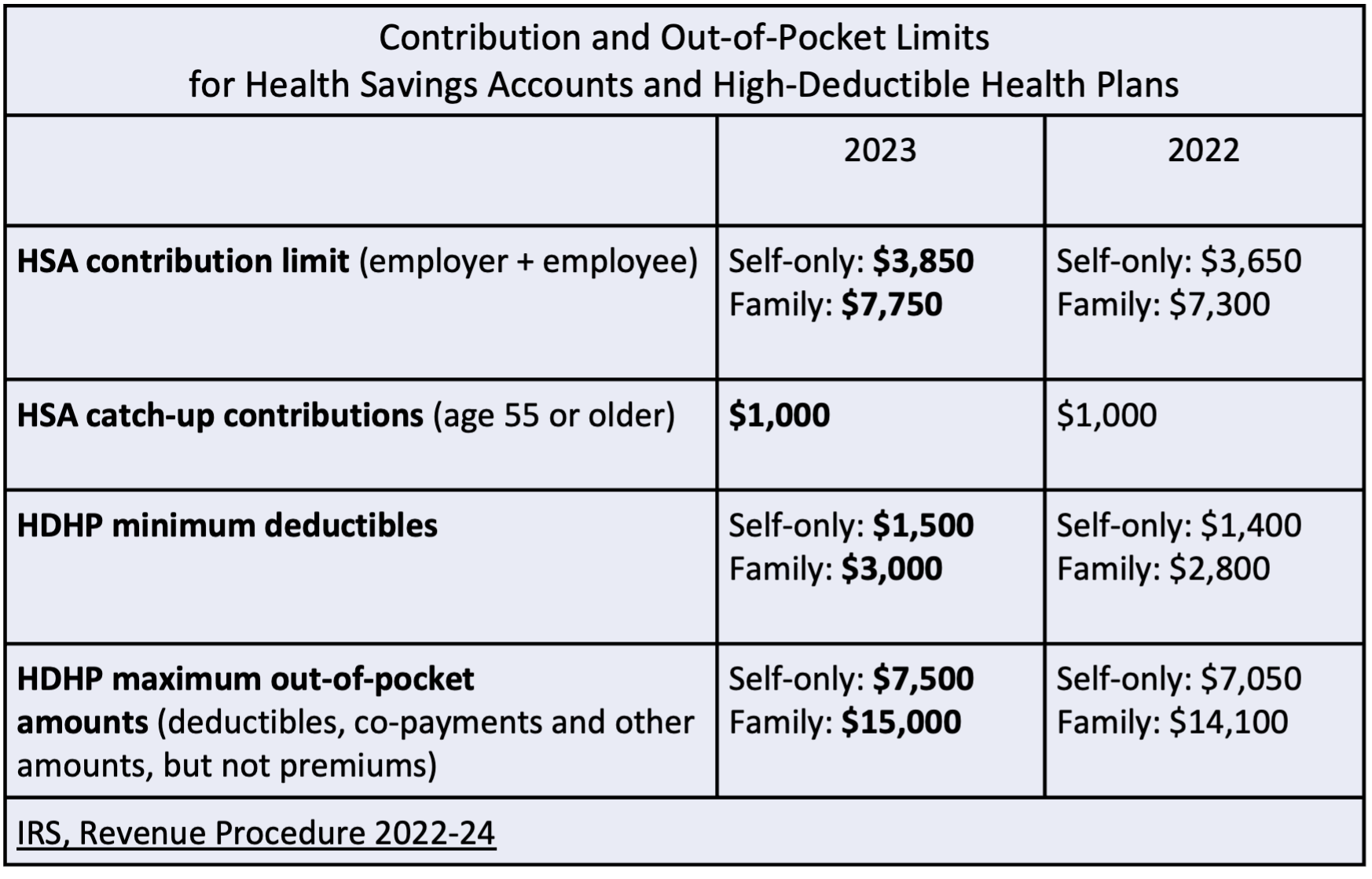

On Friday, April 29th, 2022, the IRS provided the 2023 inflation-adjusted amounts for Health Savings Accounts (HSAs) as determined under § 223 of the Internal Revenue Code and the maximum amount that may be made newly available for excepted benefit health reimbursement arrangements (HRAs) provided under § 54.9831-1(c)(3)(viii) of the Pension Excise Tax Regulations. SECTION 2.

HSA INFLATION-ADJUSTED ITEMS

Annual contribution limitation.

For calendar year 2023, the annual limitation on deductions under § 223(b)(2)(A) for an individual with self-only coverage under a high deductible health plan is $3,850.

For calendar year 2023, the annual limitation on deductions under § 223(b)(2)(B) for an individual with family coverage under a high deductible health plan is $7,750

High deductible health plan.

For calendar year 2023, a “high deductible health 2 plan” is defined under § 223(c)(2)(A) as a health plan with an annual deductible that is not less than $1,500 for self-only coverage or $3,000 for family coverage, and for which the annual out-of-pocket expenses (deductibles, co-payments, and other amounts, but not premiums) do not exceed $7,500 for self-only coverage or $15,000 for family coverage.

HRA INFLATION-ADJUSTED ITEM

For plan years beginning in 2023, the maximum amount that may be made newly available for the plan year for an excepted benefit HRA under § 54.9831-1(c)(3)(viii) is $1,950.

See § 54.9831-1(c)(3)(viii)(B)(1) for further explanation of this calculation.

EFFECTIVE DATE

This revenue procedure is effective for HSAs for calendar year 2023 and for excepted benefit HRAs for plan years beginning in 2023.

Sign-up HERE and Save $170!

Here is what all you will get:

- Boss Calls™ – Access to EVERY Boss Call™ – Past & Future.

- HelpDesk for HR VAULT – Access to all 8 of our proprietary tools and applications to make your workday simple.

- Forms, Docs, Policies and Procedures Library – 700+ samples you can download and edit to fit your needs.

- U.S. ePoster Club – Download state, city, and local posters. Both required & recommended, for all 50 states & D.C.

- Same-day email support – Write to our team of SPHR and SCP professionals with all your HR questions.

![]()